Federal Cabinet discloses agreement with KRG on salary settlement

Shafaq News / The Federal Cabinet shed light on the intricacies of the agreement it has recently inked with the Kurdistan Regional Government, a pact aimed at resolving the contentious matter of regional employee salaries, among other critical files.

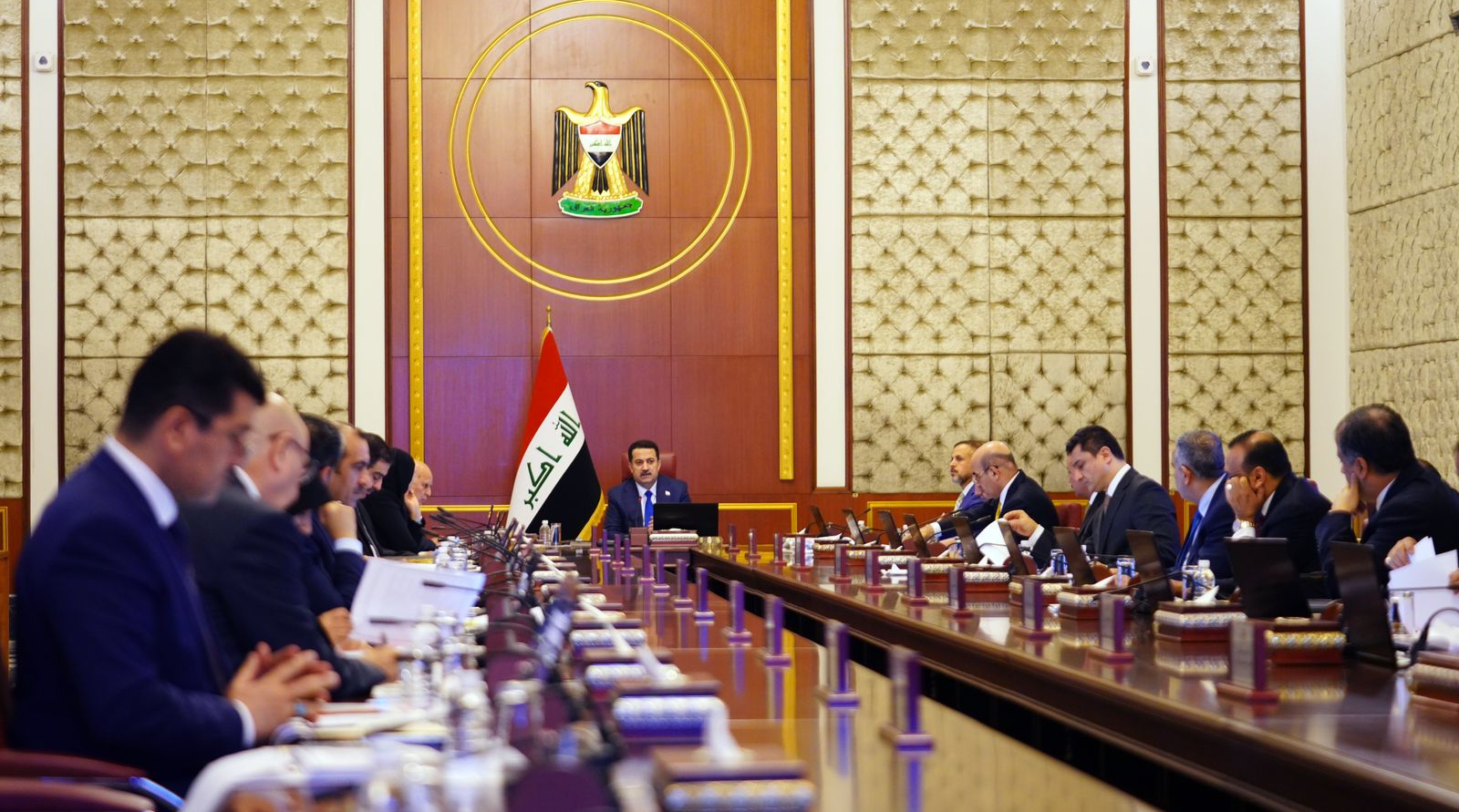

Prime Minister Mohammed S. Al-Sudani chaired the 38th Regular Session of the Council of Ministers today. During the session, the Council of Ministers discussed the country's general situation, the most prominent issues and priorities, and the items on the agenda and issued several decisions.

Based on the positive understanding between the Federal Government and the Kurdistan Regional Government of Iraq, and their commitment to fulfilling constitutional obligations and the federal budget law, ensuring the rights of all citizens, and maintaining transparent state finances, the aim is to provide financial support to the Kurdistan Regional Government. This support will cover employee salaries, social welfare recipients, and retirees until the Federal Ministry of Finance settles the Kurdistan Regional Government's obligations under the 2023, 2024, and 2025 Federal Budget Laws. Consequently, the Council of Ministers has decided to amend its prior decision, No. (23500) of 2023, as follows:

1. The Rafidain Bank, the Rasheed Bank, and the Trade Bank of Iraq (TBI) will lend the Iraqi Kurdistan Regional Government an amount of two trillion and one hundred billion dinars for the current fiscal year, to be paid in three equal installments at (700) billion dinars for each installment, starting in September.

2. The Federal Ministry of Finance will repay the loan amounts mentioned in Paragraph (1) above from the Kurdistan Regional Government allocations in the federal budget for the fiscal year 2023, after settling what is owed.

3. If the remaining share of the Kurdistan Regional Government was inadequate to cover the loan amounts mentioned in Paragraph (2) above, the Federal Ministry of Finance will settle these loan amounts using the KRG allocations within the federal budget for the fiscal year 2024. This will take precedence over any other dues to the mentioned banks, before any payments are made to the Kurdistan Regional Government.

4. The Ministry of Finance will establish a bank deposit with the aforementioned banks matching the loan amounts for each of them. This deposit will be withdrawn once the provisions of the aforementioned paragraphs (2 and 3) have been executed.

5. The Federal Board of Supreme Audit, in collaboration with the KRG Board of Supreme Audit, will conduct an audit of the employee, social welfare recipient, and retiree numbers in the Kurdistan Region of Iraq based on the lists provided to the Federal Ministry of Finance. This audit will also encompass the assessment of their salary amounts. This process should be completed within a maximum of 30 days from the issuance of this decision, in accordance with the established criteria set forth by both audit offices.

In alignment with the government program approved by the Council of Representatives, specifically Section Twelve - Paragraph (5) focusing on tax system reform and enhancing the business environment, the Council of Ministers has made the following decisions:

1. All taxpayers, including individuals, entities, companies, and offices, are required to submit their accounts and financial statements to the General Commission for Taxes after having them audited and authenticated by a certified auditor. This authentication includes verification by the Council of the Accounting Oversight and Auditing Profession of the auditor's seal and signature to ensure the accuracy of tax calculations.

2. Financial statements submitted to the General Commission for Taxes, which are not subject to audit by a licensed auditor, are based on the commercial bookkeeping system.

For the purposes of Income Tax No. (2) of 1985, what is stated in Paragraph (1) above applies, provided that it is organized by accounting regulation by the Syndicate of licensed Accountants and Auditors.

3. Tax amounts are collected in accordance with the provisions outlined in paragraphs (1 and 2) above, and upon payment, taxpayers are promptly declared debt-free.

4. The General Commission for Taxes has the authority to audit the accounts submitted in (1) above, following a mechanism developed through coordination among the General Commission for Taxes, the Federal Board of Supreme Audit, and the Iraqi Association for Certified Accountants. In cases of accounting or financial errors, the certified accountant will be held responsible, including measures to combat tax evasion.

5. All taxpayers, especially importers, are mandated to provide a document issued by the General Commission for Taxes confirming their tax debt-free status. This document will be valid for one calendar year from its date of issuance.

6. The requirement for previous and current taxpayers to undergo currency purchase inquiries at the General Commission for Taxes has been canceled.